We've launched a free data migration service

We’re more than just a software company. Look at us as an extension to your team. We want to help you systemise, scale and grow your practice!

How we can help with data migration

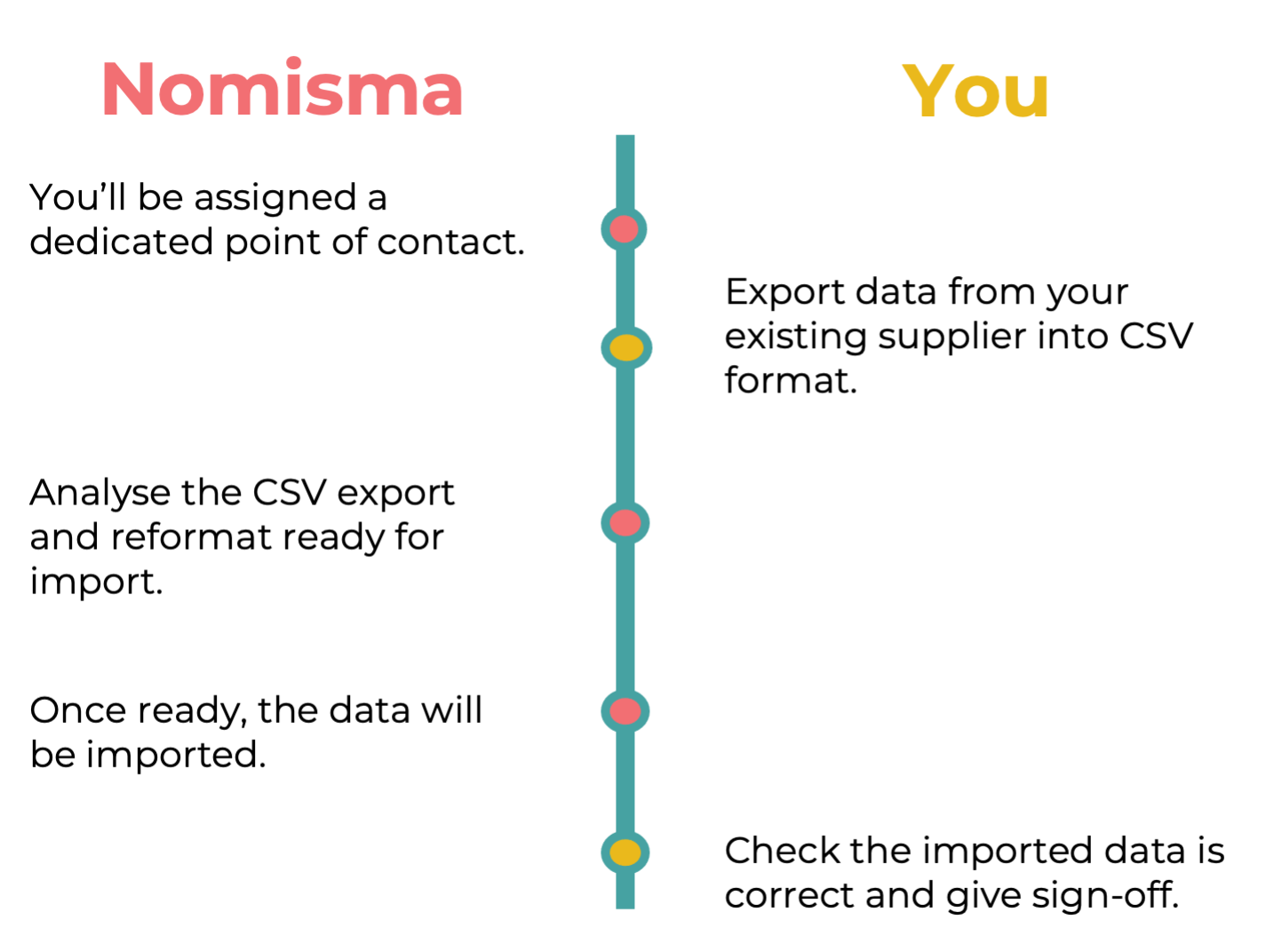

You can utilise our free service to migrate client information from other bookkeeping and payroll platforms. Here’s how it works:

What we’ll need (Teal = optional):

Payroll

1. CSV file containing all company names, PAYE reference, pay frequency and date

2. CSV file containing all employee names, tax codes, NI numbers and address

3. P11 report or CSV file containing closing balances from previous software

Bookkeeping

1. CSV file containing the current year’s trial balance

2. CSV file containing the previous year’s trial balance

3. CSV file containing all customer names, emails, phone numbers and addresses

4. CSV file containing all supplier names, emails, phone numbers and addresses

Want to import granular information?

We offer a premium, paid service where bank statements, sales invoices, supplier bills and journals can be imported. The price depends on the size of the migration, get in touch for more information:

Related Articles

Get Data From HMRC

Get Data From HMRC Once the HMRC Data Setting has been successfully set up, you will then be able to use the Get Data From HMRC option. This will pull through any data such as Employment Income, Pensions, Annuities, Benefits in Kind and any other ...HMRC Data Setting

By enabling the HMRC Data Setting, this will allow you to pull through any relevant information from the HMRC portal that you can choose to save on a client’s Self-Assessment tax return within Nomisma. To enable the HMRC Data Setting go ...Getting historical transactions via bank feeds

To pull through historical bank transaction via the bank feed feature you will first have to have a bank feed set up on Nomisma. Once a bank feed has been set up, go to Banking on the left-hand menu of the client’s main dashboard, click on the View ...Importing data from the Tax Questionnaire into the tax return

Once you have received a response for a client’s Tax Questionnaire you will then be able to import that data into the tax return that you will be submitting for them. Go to the Agent Self-Assessment dashboard, scroll down to the table that shows ...We're committed to supporting practicing accountants and bookkeepers.

Recently there’s been speculation in the profession on whether MTD could spell the end for accountancy and bookkeeping firms. We don’t think so. Concerns have also been aired that software suppliers would ‘cut practices out of the loop’ by supplying ...